Verify the PCB amount with an LHDN-approved HR tool. Check it out for yourself in a 30-day free trial with Talenox.

Individual Income Tax In Malaysia For Expatriates

You still have the option to.

. Kalkulator PCB - Lembaga Hasil Dalam Negeri. Individual Income Tax Return Frequently Asked Questions for more information. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR.

How To Pay Your Income Tax In Malaysia. Headquarters of Inland Revenue Board Of Malaysia. A 2 Withholding Tax WHT will be imposed to agents dealers and distributors whose commissions surpasses RM100000 within 1 year.

The income of a listed IHC is treated as business income and expenses are given full tax deduction. Unabsorbed losses and capital allowances cannot be taken forward. Employers Responsibility The employer is obligated to inform the assessment branch of IRBM by filing and submitting a CP 22 form.

How Does Monthly Tax Deduction Work In Malaysia. An unlisted IHC may claim deductions for a certain proportion of administrative expenses such as staff wages and management fees. Official PCB Calculator from LHDN Hasil.

Guide To Using LHDN e-Filing To File Your Income Tax. Heres How A Tax Rebate Can Help You Reduce Your Tax Further. Payroll software like Talenox are LHDN-approved and available for companies to ensure the accuracy of their PCB calculation.

This method of e-filing is becoming popular among taxpayers for its simplicity and user-friendliness. This ruling takes in effect as of 1st January 2022. You can file Form 1040-X Amended US.

Such deductions are limited to 5 of the total gross. Taxpayers can start submitting their income tax return forms through the e-Filing system starting from March 1 of every year unless otherwise announced by LHDN. Likewise if you need to estimate your yearly income tax for 2022 ie.

Remember that R is the percentage of tax rate which is a fixed 15 for a KWASR. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving Malaysia.

See Form 1040-X Amended US. Employer is not required to send notification using CP22 to the IRBM if. The new employee is not subject to income tax.

Form CP22 is a report from the government issued by the LHDN and also a form for New Employee Notification. Assessment year 2023 just do the same as previous step with your estimated 2022 total income but choose 2022 for PCB year. The 2 withholding tax is charged on the sales services transactions and programs carried out by the agents dealers and distributors.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

Corporation Income Tax Filing Scarborough Filing Taxes Tax Consulting Income Tax

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Malaysia Personal Income Tax Guide 2022 Ya 2021

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Brownies 1 Savory Snacks Tart Baking Microwave Recipes

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Simple Pcb Calculator Malaysia On The App Store

Simple Pcb Calculator Malaysia By Appnextdoor Labs

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Pay Calculator With Taxes Price Guarantee 67 Off Aarav Co

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To Do Pcb Calculator Through Payroll System Malaysia

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

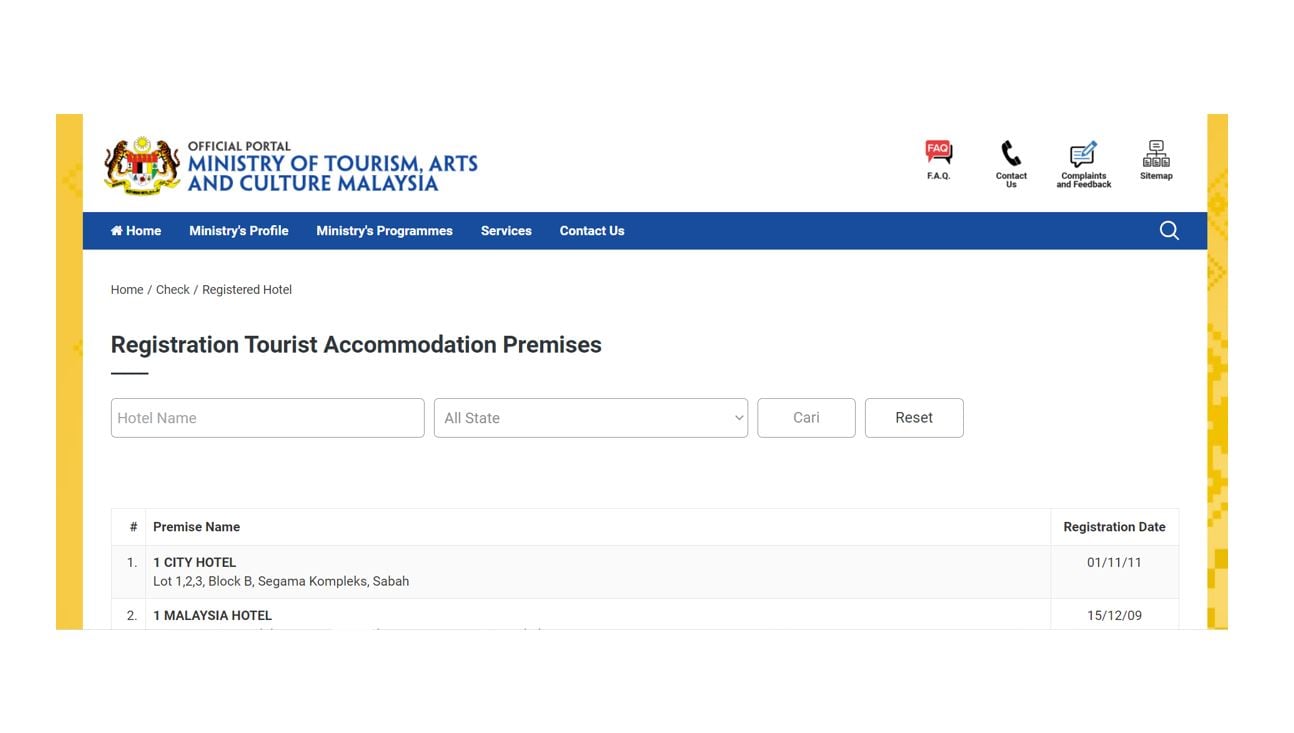

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Updated Guide On Donations And Gifts Tax Deductions

Malaysian Tax Issues For Expats Activpayroll